Best Automated Invoice Processing Tools

Not all OCR tools are created equal. Here's what to look for in automated invoice processing tools.

For Finance departments, managing invoices can be one of the most time-consuming and labor-intensive tasks. Automating the Accounts Payable (AP) process has become increasingly popular, and at the heart of this automation lies a crucial technology: Optical Character Recognition (OCR). While many companies have embraced OCR to streamline their invoice processing, not all OCR tools offer the same level of performance in extracting data and eliminating the need for manual data entry. Selecting the right tool can make a significant difference in how efficiently and accurately invoices are processed. This article will explore the differences between basic and advanced OCR capabilities and what you should be looking for when considering automated invoice processing tools.

What Is OCR?

Optical Character Recognition, or OCR, is a technology that converts different types of documents—such as scanned paper documents, PDFs, or images—into editable and searchable data by recognizing and extracting text. Essentially, OCR allows businesses to digitize physical documents, transforming them into machine-readable text that can be manipulated for various purposes. It’s particularly useful in Accounts Payable because, when implemented correctly, it eliminates the need for manual data entry, speeding up the entire invoice processing workflow.

OCR in AP Automation

Accounts payable departments deal with a high volume of invoices weekly, many of which are received in paper form or as non-editable PDFs. Manually keying in invoice data into accounting systems or ERP software is labor-intensive and often error prone. OCR simplifies this process by scanning the invoices and extracting key data—such as vendor information, invoice numbers, dates, and amounts—automatically. Once this information is captured, it can be populated into accounting systems or ERP software, reducing the need for manual input.

However, while OCR tools are a cornerstone of AP automation, the effectiveness of the process can vary greatly depending on the OCR tool’s sophistication.

Common Problems with Basic OCR Tools

Many businesses, especially small to medium-sized ones, rely on basic OCR tools to handle their invoice processing. While these tools can extract text from documents, they often fall short when dealing with the complexities of real-world invoices. Here are some common issues that arise with basic OCR tools:

1. Complex and Multi-Page Invoices

Invoices come in various formats, and more complex invoices for example handwritten invoices or those in non-standard formats and layouts can be a challenge for basic OCR tools to read. This will result in key information being extracted incorrectly or missed, so AP teams will still need to perform manual data entry where there are gaps in the data. A standard OCR engine might also struggle to interpret and separate multi-page invoices, which is businesses often have because of scanning multiple invoices sent in the mail.

2. Header-Level vs. Line-Level Data Extraction

In invoice processing, it’s crucial to differentiate between header-level and line-level data. Header-level data includes general information like the vendor name, invoice number, and total amount. Line-level data, on the other hand, refers to the individual items, quantities, and prices on the invoice. Basic OCR tools often have trouble distinguishing between these two levels, leading to inaccuracies in data capture. Many OCR tools just capture the summary of header data for simplicity, however this means AP teams need to manual key in line level data when required.

3. Inaccurate Mapping

Incorrectly coded invoice data often requires manual corrections. Basic OCR tools lack the capability to intelligently map items, relying heavily on templates and leading to frequent misclassifications. These tools typically do not “learn” from past corrections, allowing recurring errors to persist. For instance, a basic OCR tool might read the Invoice Total and the Total Amount, but if payments are based on the invoice due amount, which appears on a different line, the tool won’t adapt. Even after correcting it once for a specific supplier, the tool won’t remember this adjustment for future invoices, necessitating manual changes each time due to its reliance on a static template.

4. Lack of Error Learning and Adaptation

Basic OCR tools generally don’t offer the ability to learn from their mistakes. For instance, if a particular vendor’s invoice format is consistently misread, the system will not improve over time and will continue to encounter these errors week on week. This lack of adaptive learning means users must continually intervene to correct the same errors, negating some of the time-saving benefits that automation is supposed to offer.

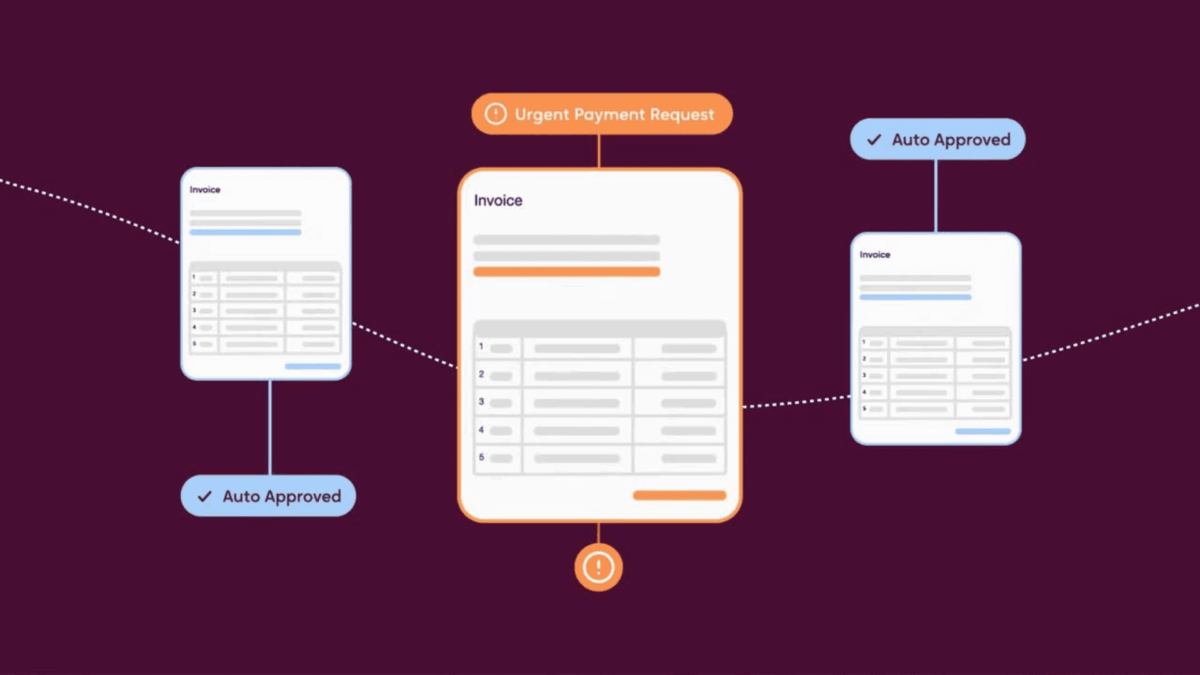

OCR + AI + Machine Learning: The Next Evolution

The shortcomings of basic OCR tools have led to the development of more advanced solutions that combine OCR with artificial intelligence (AI) and machine learning (ML) capabilities. These tools are designed not just to extract data but also to understand it, learn from past actions, and improve accuracy and efficiency over time. Here’s how combining OCR with AI and ML can revolutionize invoice processing:

1. Better Handling of Complex and Unstructured Invoices

AI-powered OCR tools can analyze and process invoices of various layouts and complexities, recognizing patterns in the data to extract relevant information. Hand written invoices with non-standard formats can be accurately processed by leveraging AI’s Natural Language Processing (NLP) ability to read what the human eye can see and truly “understand” context.

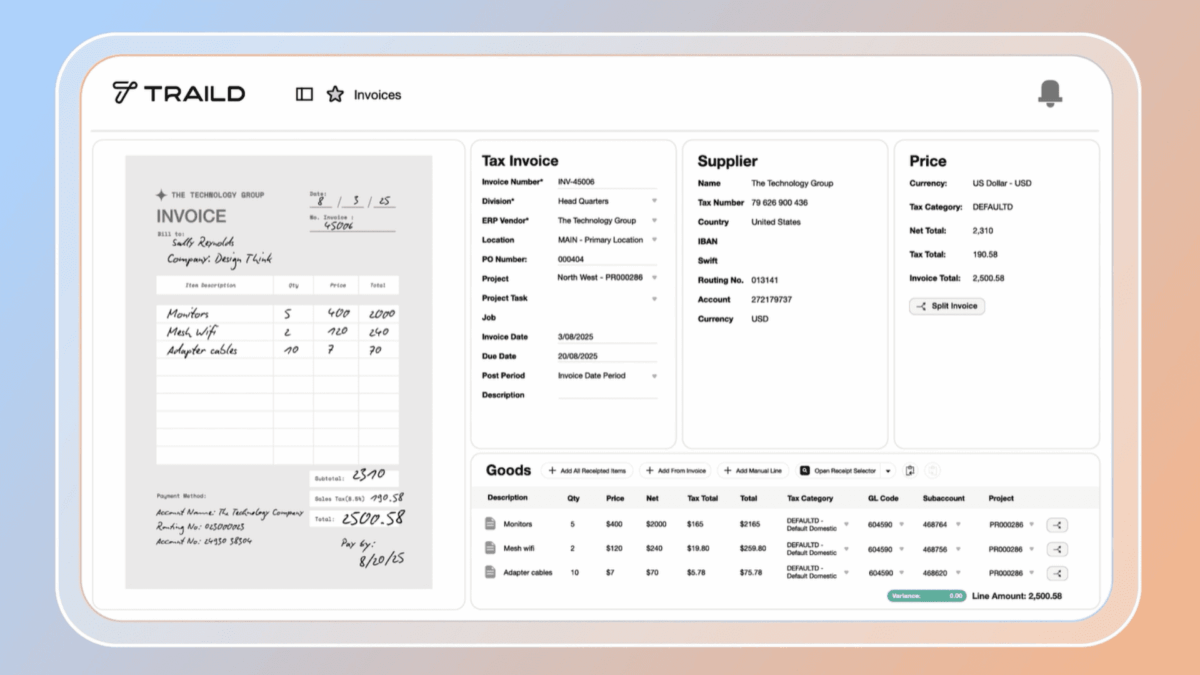

2. Accurate Line-Level Data Extraction

Advanced OCR tools enhanced with AI can differentiate between header-level and line-level data, ensuring that both types of information are captured correctly. For businesses dealing with detailed invoices—such as those in manufacturing or retail—this capability is crucial for accurate cost tracking and reporting at the line-item level.

3. Intuitive Mapping

A key advantage of integrating OCR with AI and ML is its ability to adaptively map invoice data to the correct classifications and automatically assign GL codes to the appropriate line items. Over time, the system learns from previous inputs and human corrections, significantly reducing errors and minimizing the need for manual intervention. This continuous learning process ensures more accurate and efficient invoice processing.

4. Continuous Learning and Improvement

Unlike static OCR tools, systems enhanced with AI and ML are dynamic. They learn from every invoice processed, both by your business and across their network, improving their accuracy with each iteration. As the system gets smarter, it becomes better at recognizing vendors, invoice layouts, and your AP intricacies.

What to Look for in Automated Invoice Processing Tools

When evaluating automated invoice processing tools, it’s essential to consider the following features:

- AI and Machine Learning Capabilities: Look for tools that go beyond simple OCR to offer AI and ML, enabling them to improve over time.

- Accuracy in Complex Scenarios: Ensure the tool can handle complex and multi-page invoices and can accurately extract line-level data.

- Customization and Flexibility: The ability to tailor the tool to your specific AP needs is essential, especially in areas like GL code mapping and workflow integration.

- Error Correction and Learning: Choose a system that learns from human corrections and improves its performance over time, reducing the need for manual oversight.

- Seamless Integration: The tool should easily integrate with your existing accounting software or ERP system to avoid disruptions in your workflow.

Conclusion

While OCR has revolutionized invoice processing, not all OCR tools are created equal. Basic tools may offer short-term convenience, but their limitations—particularly in handling complex invoices and learning from errors—can hinder long-term efficiency. Combining OCR with AI and machine learning offers a more robust solution, providing greater accuracy, adaptability, and automation. When selecting an automated invoice processing tool, it’s crucial to prioritize these advanced features to ensure your AP department operates at peak efficiency.

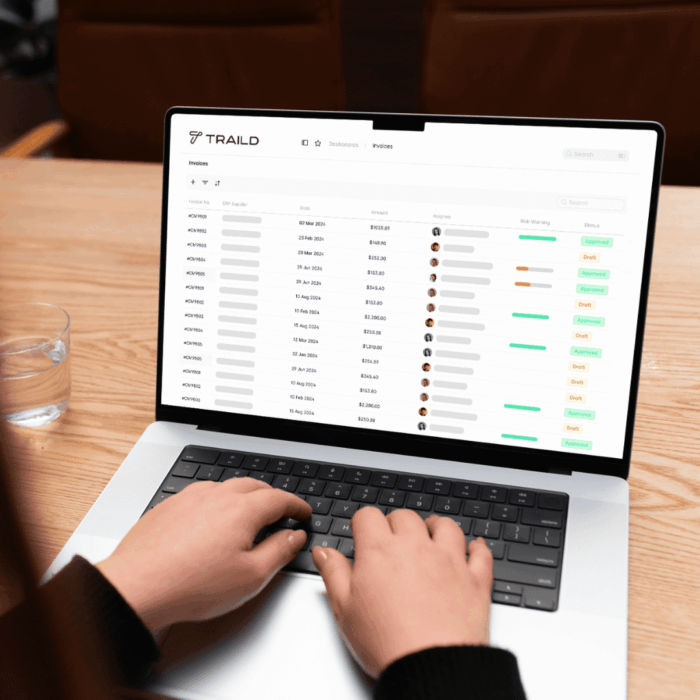

See Traild in Action

See how Traild can streamline your processes with a personalised walkthrough from our team.