Vendor Verification and Validation for Added Fraud Protection

With meticulous, AI-enabled protocols, Traild Vendor Verification fortifies your risk management posture, without slowing you down.

AI-Enabled Vender Verification

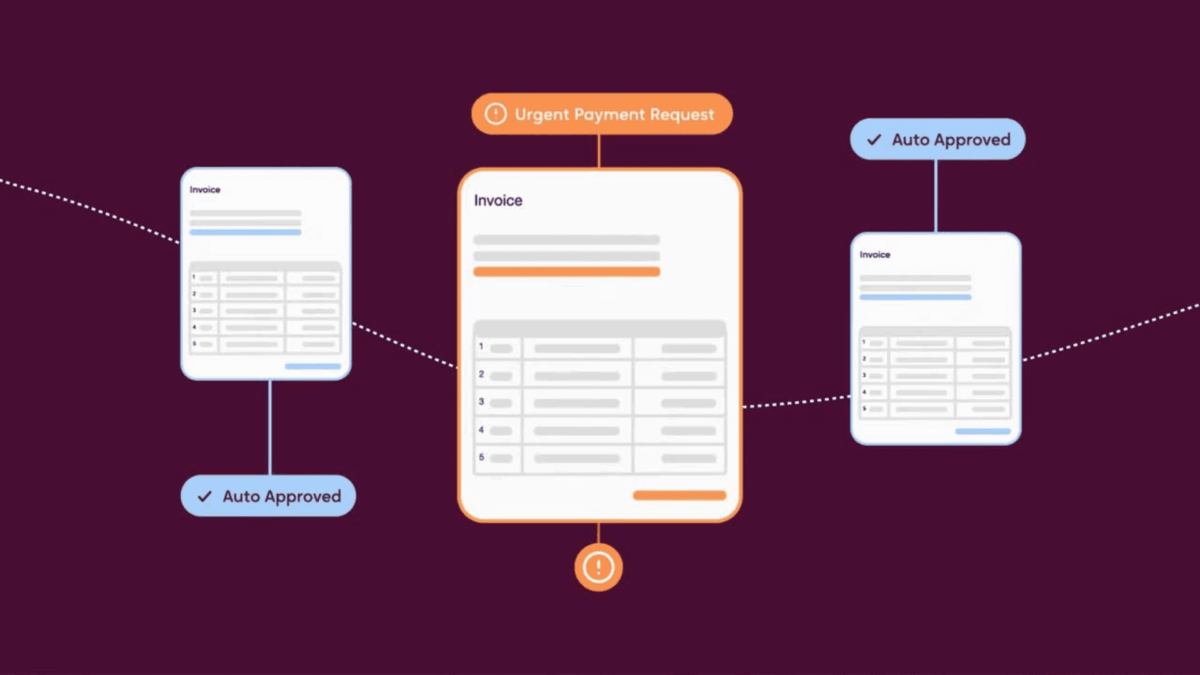

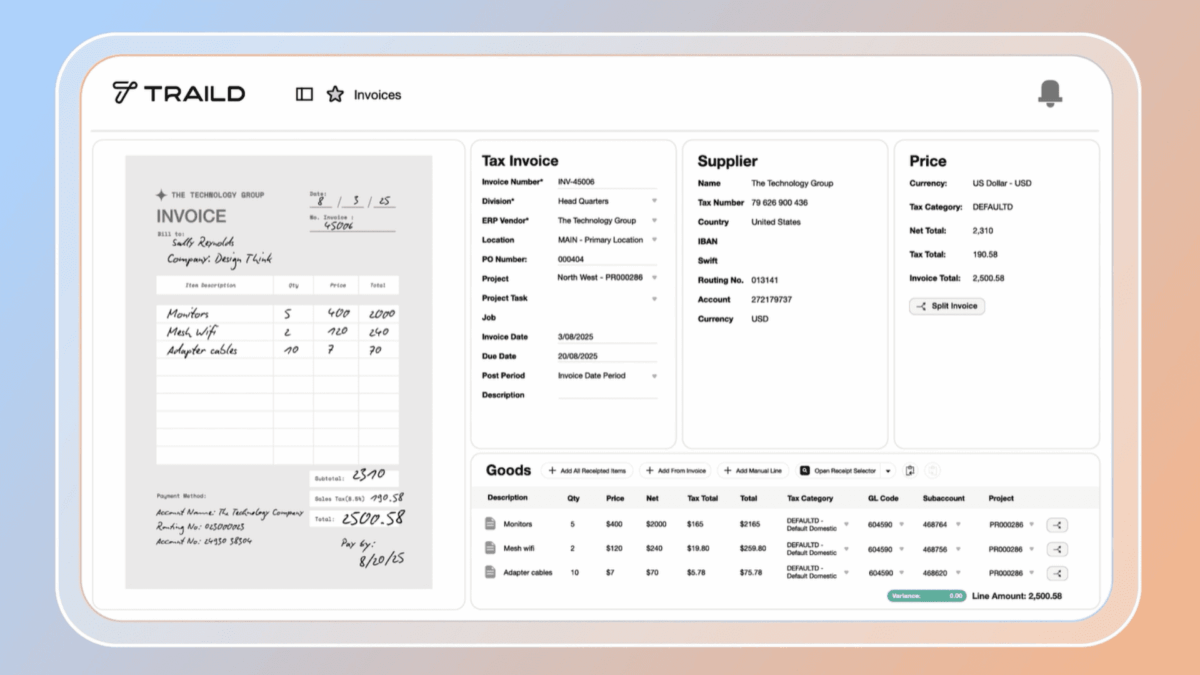

Traild uses a proprietary AI-enabled vendor validation protocol to execute verification quickly and effectively. Key details are automatically extracted from each new vendor invoice for verification, so you can feel confident making payments immediately.

Collective intelligence

Companies around the world rely on Traild for vendor verification, so the platform holds standard data for thousands of vendors. This collective intelligence ensures Traild can quickly validate or identify anomalies for common vendors.

Key Benefits of Vendor Verification

Know new vendor details are verified and trusted with Traild cross-checking key information including bank accounts, business credentials and identity.

Data on vendors you work with contributes to collective intelligence that protects your business and others. Insights on vendor behavior from across the Traild network is used to detect risks and avoid fraud. Everyone’s fraud protection is fortified.

Traild enables you to only pay the right accounts by verifying vendor details before payments take place. If a vendor cannot be verified, it raises a red flag, encouraging caution and closer inspection.

Took less than a week to roll out

"It took us less than a week to get Traild rolled out and my team comfortable with using it. We could see the benefits right away! It has already saved us from paying the same supplier invoice twice by mistake!"Add an extra layer of security

"We had a couple of near misses with incorrect supplier invoices, so we were looking to protect ourselves and add extra layer of security across the company. Traild was a winner."Frequently Asked Questions

Reach out to our team for more information on Traild or AP digital transformation.

Verifying vendors helps protect against fraudulent activities. It ensures that the business is dealing with legitimate and trustworthy vendors, reducing the risk of scams and financial losses.

In today’s environment of increasing payment fraud, manual checks and static vendor records aren’t enough. Businesses are vulnerable to incorrect bank details, vendor impersonation and invoice scams, often caused by weak or outdated validation processes.

Vendor validation involves checking that vendor information, such as business names, ABNs and contact details are accurate and complete. Traild automates this by extracting data from invoices and comparing it to its own and publicly available records and your vendor records to detect discrepancies early.

To further strengthen your protection, explore Traild Accounts Payable for real-time anomaly alerts, invoice risk scoring and advanced fraud prevention tools.

Yes. Traild monitors your vendors in real-time and alerts for any changes in their status, details or risks.

Yes, even if you mainly work with existing vendors you know well, vendor verification is still crucial. Your vendors can be vulnerable to Business Email Compromise (BEC) attacks, where cybercriminals impersonate them to request changes in payment details. Relying solely on human checks can miss these fraud attempts, leaving you open to significant financial losses. Regular verification helps ensure that any changes in bank details or other critical information are legitimate, protecting your business from potential fraud.